The Ultimate Guide To International Debt Collection

Wiki Article

How International Debt Collection can Save You Time, Stress, and Money.

Table of ContentsThe Definitive Guide to International Debt CollectionPersonal Debt Collection for DummiesDental Debt Collection - TruthsThe Best Strategy To Use For Personal Debt Collection

The financial obligation purchaser purchases just a digital file of info, typically without sustaining evidence of the financial debt. The financial obligation is additionally typically older debt, occasionally referred to as "zombie financial obligation" because the debt purchaser attempts to restore a financial obligation that was beyond the law of constraints for collections. Financial debt debt collector might call you either in writing or by phone.

Not chatting to them will not make the financial obligation go away, and they might simply attempt alternate methods to call you, including suing you. When a debt collector calls you, it is essential to get some initial details from them, such as: The financial obligation enthusiast's name, address, as well as telephone number. The overall quantity of the debt they assert you owe, including any kind of charges as well as rate of interest fees that might have accumulated.

How Private Schools Debt Collection can Save You Time, Stress, and Money.

The letter needs to state that it's from a financial debt collector. Name as well as resolve of both the financial debt collection agency and also the borrower. The financial institution or financial institutions to whom the financial debt is owed. An inventory of the debt, including costs and passion. They need to also notify you of your rights in the debt collection procedure, and how you can challenge the financial debt.If you do contest the financial obligation within one month, they need to stop collection initiatives till they offer you with proof that the financial debt is yours. They have to give you with the name and also address of the original lender if you ask for that information within one month. The financial obligation recognition notice should consist of a form that can be made use of to call them if you wish to contest the financial obligation.

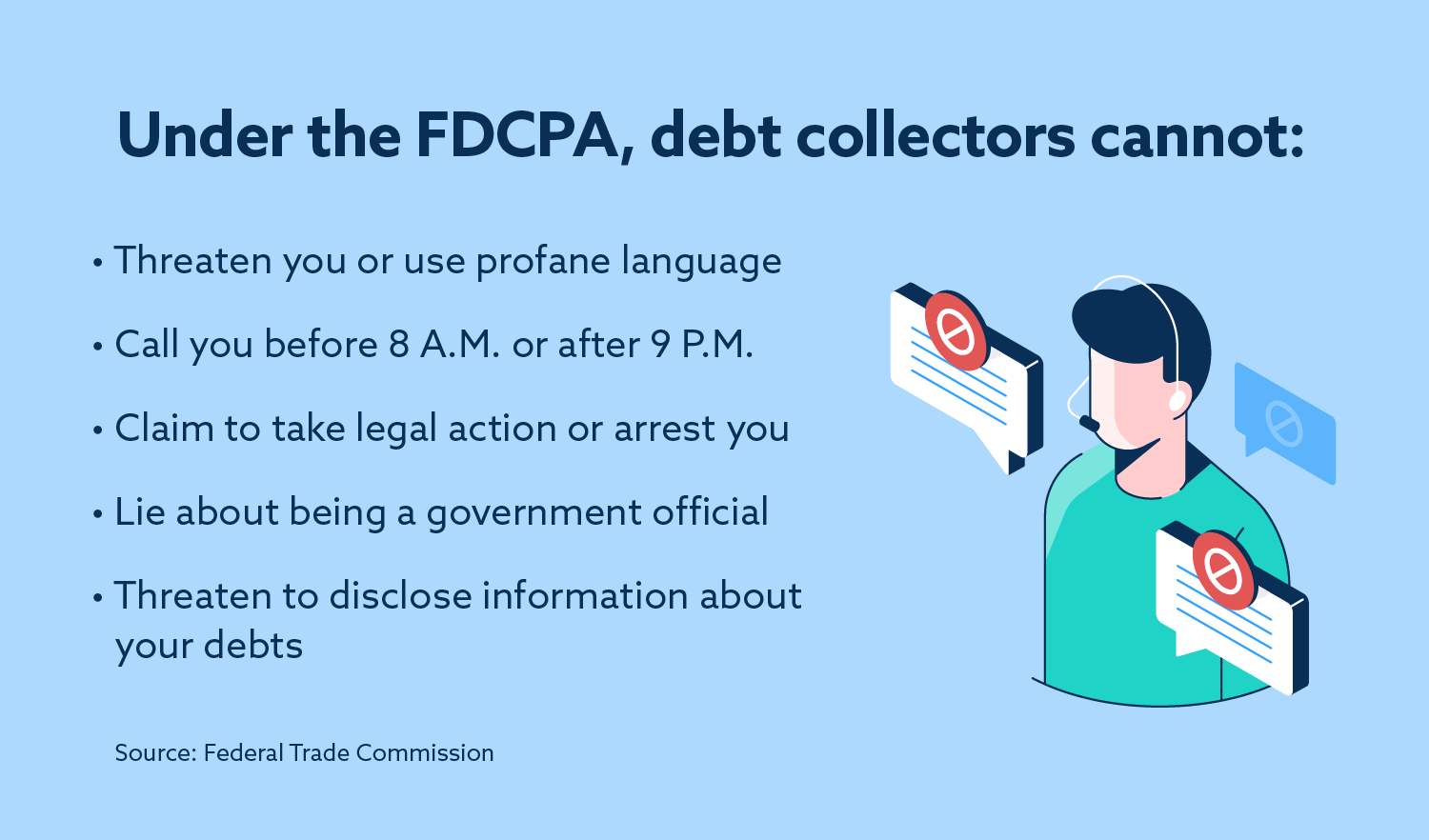

Some points debt enthusiasts can refrain are: Make duplicated calls to a borrower, planning to annoy the debtor. Intimidate physical violence. Use profanity. Lie regarding exactly how much you owe or act to call from an official government office. Usually, overdue debt is reported to Learn More the credit scores bureaus when it's 30 days unpaid.

If your financial obligation is transferred to a financial debt collection agency or offered to a financial debt customer, an entry will certainly be made on your credit rating record. Each time your financial debt is offered, if it proceeds to go unpaid, an additional entry will certainly be contributed to your credit rating record. Each negative access on your credit report can remain there for as much as 7 years, even after the financial obligation has been paid.

The 5-Minute Rule for Personal Debt Collection

What should you anticipate from a collection company and also exactly how does the process job? Continue reading to discover. When you've made the choice to hire a debt collection agency, make sure you select the right one. If you adhere to the recommendations listed below, you can be certain that you've worked with a trustworthy agency that will handle your account with care.For instance, some are better at getting results from bigger businesses, while others are competent at accumulating from home-based businesses. See to it you're collaborating with a company that will actually serve your demands. This may seem noticeable, yet prior to you hire a debt collector, you require to guarantee that they are certified and also accredited to act view publisher site as financial obligation enthusiasts.

Prior to you begin your search, recognize the licensing needs for debt collection agency in your state. That method, when you are speaking with companies, you can speak wisely regarding your state's demands. Get in touch with the firms you talk to to guarantee they satisfy the licensing requirements for your state, especially if they are located in other places.

You ought to additionally contact your Better Company Bureau and the Commercial Debt Collection Agency Organization for the names of respectable and highly regarded financial debt collectors. While you might be passing along these financial obligations to an enthusiast, they are still representing your business. You require to recognize just how they will certainly represent you, just how they will function with you, as well as what pertinent experience they have.

The Ultimate Guide To Business Debt Collection

Even if a tactic is legal does not indicate that it's something you desire your company name related to. A trustworthy financial debt enthusiast will deal with you to set out a strategy you can deal with, one that treats your previous clients the means you 'd intend to be dealt with and still gets the job done.If that occurs, one technique lots of firms make use of is miss tracing. That means they have access to particular databases to assist locate a debtor who has actually left no forwarding address. This can be a great method to ask regarding specifically. You ought to additionally explore the collector's experience. Have they functioned with companies in your sector before? Is your scenario beyond their experience, or is it something they recognize with? Appropriate experience increases the possibility that their collection efforts will be effective.

You ought to have a factor of call that you can communicate with as well as obtain updates from. Business Debt Collection. They need to be able to clearly verbalize what will certainly be gotten out of you in the procedure, what information you'll need to supply, and also what the tempo and also activates for communication will be. Your picked firm should have the ability to fit your picked communication needs, not require you to approve their own

Despite whether you win such a case or otherwise, you want to be sure that your firm is not the one on the hook. Request for evidence of insurance policy from any debt collector to secure yourself. This Read Full Report is most usually called an errors and also noninclusions insurance coverage. Debt collection is a solution, and also it's not a low-cost one.

Report this wiki page